High growth companies are often high-growth. Set significant goals, knowing full well that the idea of an “overnight success” is for storybooks. It is a good time to plan for the transition from a private to a public company, but it is not the best time.

Strategic planning is time-consuming and essential to eliminate risk on the public path. Companies that plan to go public in three years or less should start planning now to be able to launch, despite the downturn.

Let’s look at why this is a good place to plan an IPO and what you can do about it.

Recent withdrawals by growth investors have been common

While some companies may delay IPOs, others can catch up and prepare to invest again when the open markets are ready.

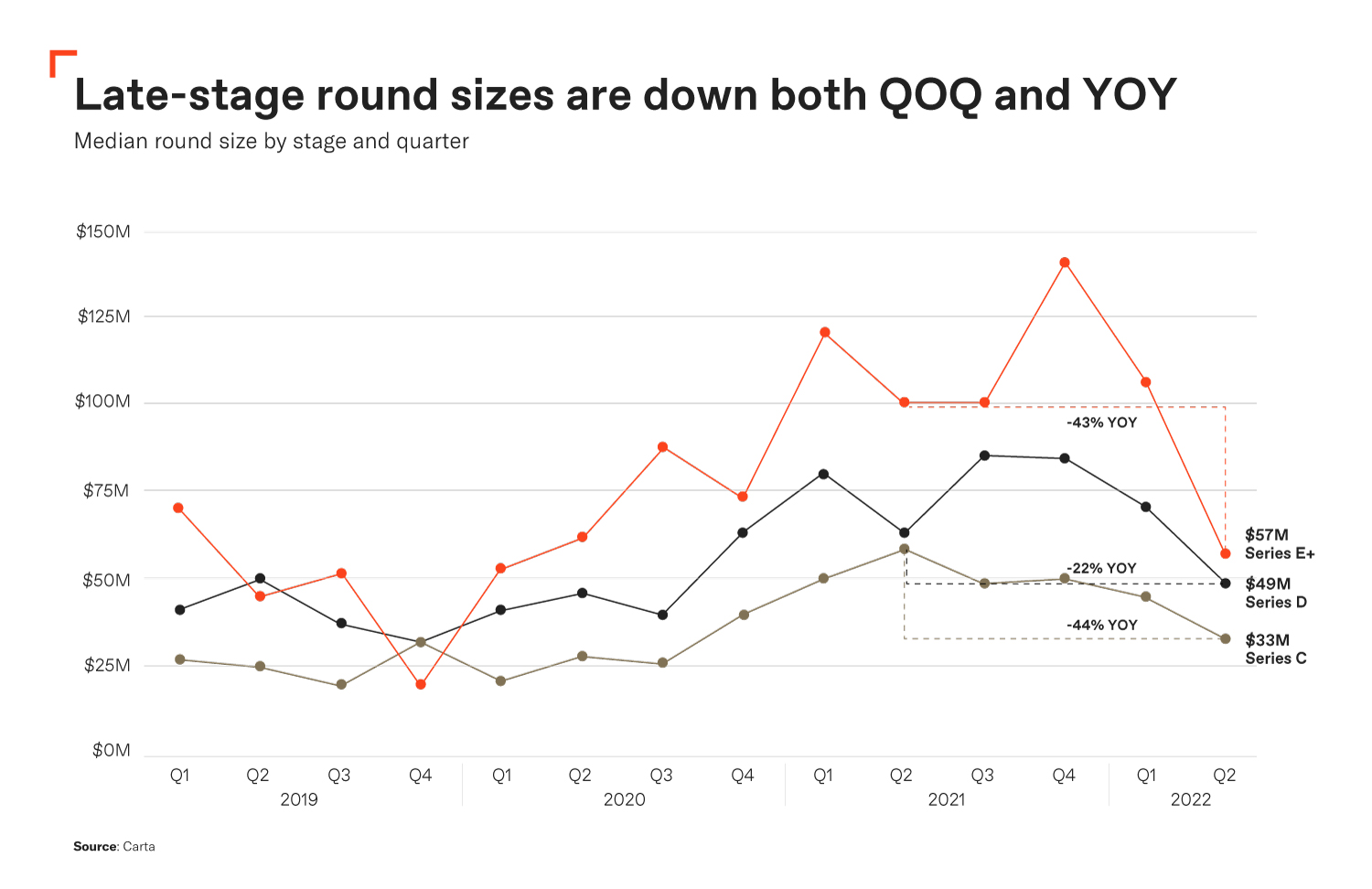

Carta report Private fundraising levels have decreasedThe United States saw a record breaking 2021. Companies in the second phase have been the most affected.

Market experts cheer the leaders currently NotThey are unable to rely on the liquid capital available, even though there is plenty. The chart below shows that the number of funding rounds has decreased in the last phase.

Credits for the image:Shield founder

Even though few people enjoy a market decline, it can be a valuable lesson for companies in the late stages who pay attention to how it happened. Many leaders embrace a message. Sequoia note. We can agree with their ideas of prioritizing profits over growth — the scaling is different than it used to be, and we’ve got to swallow that rough pill.

However, it’s not all bad and boring to cut costs and give up on fundraising. There will always be an innovative founder who finds the money if there is enough. It’s something we see every day. The path now looks very different.

Market decline triggers valuation corrections

Market downturns are a common reason for course correction. After swinging in one direction for a while the pendulum moves towards a more balanced level. In this case, the open markets thrived on high valuations. Most startups are overvalued before 2021.

Many people also said that 2021 was a remarkable year, especially considering that venture capital investments nearly doubled to $643billion. The US saw more US unicorn companies than 580 and more than 1,030 initial public offerings (more than half of them SPACs), which is a higher percentage than the previous year. It received only 170 public listings in this year.

Source link

[Denial of responsibility! reporterbyte.com is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – reporterbyte.com The content will be deleted within 24 hours.]