Welcome to The Interchange! Thank you for signing up to receive this email and for your vote of confidence. If you’re reading this as a post on our site, sign up hereYou can then receive it directly in future. Every week, I’ll take a look at the hottest fintech news of the previous week. This will include everything, from trends and funding rounds to analysis of a specific space to hot takes about a company or phenomenon. There’s a lot of fintech news out there and it’s my job to stay on top of it — and make sense of it — so you can stay in the know. — Mary Ann

Hello! It’s my first full week back in some time, and I’m excited. It turned out that COVID helped me get more sleep than I’ve had in a long time. (Silver linings.)

The week of Thanksgiving turned out to be less boring than I expected — I reported that three of alternative financing startup Pipe’s co-founders were stepping down as the company searched for a “veteran” CEO to take the company to the next level.

For context, I have been covering PipeCraft Ventures led a seed round that raised $6 million for the company in 2019. It has grown in many ways over the years. I have kept in touch over the years with Harry Hurst (its CEO and co-founder). I was shocked to learn that Harry Hurst, the CEO, was planning on leaving the company with two of his cofounders. This is not a typical thing. Co-founders don’t often step down so soon after a company was founded and achieved unicorn status. And it’s practically unheard of for three co-founders to leave At the same moment.

After that article published, I was inundated with tweets, messages, and so on…with a number of allegations around “the real reasons” that Pipe’s co-founders were stepping down. Among the rumors was that Pipe had made loans of approximately $80 million to crypto mining companies. The outfit or outfits have since gone out of business and the $80 million is believed to have been completely written off, these individuals claimed (many of whom said they had “heard” about the events).

To be clear, if we reported on every rumor we heard here at TechCrunch, we’d turn into the “National Enquirer” of the startup world. It is irresponsible not to follow up on claims made by reporters when they are given the same information from multiple sources they trust and know. So that’s what I did.

Pipe, ultimately denied the claims against itBut, in all that denial, a few interesting things emerged. First, the startup’s board — despite its long list of investors — consists of only the three co-founders who are stepping down and one independent director, Peter Ackerson, a general partner at Fin Capital who himself became a VC just three years ago. Second, I found out that once a new CEO is found, that individual will assume Hurst’s seat on the board.

Now, I am not here to “take sides.” I don’t know what truly has, or has not, gone down behind the scenes at Pipe. This all struck me odd, regardless. One, how can a startup worth $300 million and valued at $2billion not have a more independent board. Two, why would Hurst — who has been the very vocal frontman of Pipe since its inception — leave the board? Finally, it turns out there is a fourth co-founder, Michal Cieplinski, whose name was notably not mentioned at all when the other three founders’ departures were announced. He is still the chief business officer.

For now, I can only relay what I have been told. As time goes on, we’ll see if more details surrounding this unusual development emerge.

Image CreditsPipe

X1

Pipe refused to disclose details about its financials when Pipe was asked. It felt even more refreshing to hear that consumer fintech was available. X1In an interview last week, the company happily shared details about its revenue. The company was created in 2020 to offer consumers a credit-card based on income, not credit scores. It launched the credit card to general public in September after accumulating 600,000. While I don’t know how many cardholders the company currently has, I was impressed that it has seen its revenue triple over the past 6 months — from $1 million per month to $3 million per month, giving it an annual revenue run rate of $36 million. It’s not bad. Not bad at any rate.

X1 is one fintech that I have not covered that chose to not raise money in 2021. This may have been a very smart decision. Its valuation was not inflated, so after raising $25 million earlier this year in a Series B round, investors clamored to offer it another $15 million earlier this month — at a 50% higher (undisclosed) valuation.

In a sector that has seen a lot of hype and chest-beating over recent years, the startup is feeling low-key. It recently lured away an Apple exec to serve as its chief risk officer, and according to CEO and co-founder Deepak Rao, it’s already conducting audits (others in the space should take note!).

As it prepares to launch its own investing platform, the company is taking on Robinhood and other similar companies. It’s a novel concept and we’ll see how it works out. On that topic, one thing I found interesting: FPV Ventures, a venture firm founded by Google Analytics founder Wesley Chan, led X1’s $25 million Series round. Chan was also an investor in Robinhood. X1 declined comment, but it is yet another example of VCs backing startups very similar to those they have backed in the past. In a world where companies are constantly evolving and iterating, it shouldn’t be shocking. But it does feel a bit…awkward, to say the least.

Weekly News

StripeIt was announced as built a fiat-to-crypto onramp. The company described it as “a customizable widget that developers can embed directly into their DEX, NFT platform, wallet, or dApp. Stripe claims to handle all the KYC, payments, fraud, and compliance and that the on-ramp can be integrated “with just 10 lines of code.” Romain goes deeper on the topic here.

Eric Wu, cofounder Opendoor, stepped down from his role as CEOReal estate fintech. Carrie Wheeler, who has served as the company’s CFO for just over two years, is taking over the role of CEO. Wu will now serve as president of Opendoor’s new marketplace offering, Opendoor Exclusives. At the time of the launch last month, Wu said: “We’ve designed Opendoor Exclusives to be a new marketplace where you can directly buy and sell a home, without any of the hassle of the traditional real estate model.”

Finextra reported that “KlarnaA platform that connects creators and influencers with retailers that can help them reach their target market has been launched by the company. The Creator Platform promises to match retailers with the right influencers and then track performance metrics — including traffic, sales and conversion rates — in real time. Already live in the US, it is now available in all markets in which Klarna operates, providing an additional marketing channel for the firm’s 450,000 retail partners.”

News like this doesn’t exactly bolster the case for fintech. According to the Chicago Sun-Times, “since 2020, more than 3,500 complaints have been filed about San Francisco-based ChimeFinancial Inc. has been contacted by the federal Consumer Financial Protection Bureau regarding closed accounts, unauthorized charges, or other issues. Most are marked ‘closed with explanation,’ meaning the company resolved them privately with the customer…Some Chime customers who have complained about sudden account closures were shocked to hear that it could take up to a month to get their money back.”

As reported by the very talented Joanna Glasner, who writes for my former employer, Crunchbase News: “Last year, financial services was the leading sectorVenture investment is a huge industry with at least $131 trillion globally going to startups in the space. The industry continues to be one of the largest recipients for venture capital funding. However, investment in startups in this space has been declining quarter by quarter. with Q4 likely to be the lowest yet.”

American ExpressB2B payments will be explored further. The credit card giant, Credit Card XL, launched December 1 Amex Business Link. A spokesperson told me this will offer “a new B2B payments solution for network issuers and acquirers to offer to their business customers.” Its goal is to provide “more streamlined, efficient, and flexible ways for businesses to pay each other on the Amex network”

TechCrunch+ – Seen

It is FTX’s failure a stress test for corporate credit card startups? As reported by Natasha Mascarenhas: “RampRecently, the company sent a message advising crypto companies that it is significantly lowering spending caps and adding new requirements. Some users were temporarily suspended from spending altogether…While Ramp somewhat backtracked on the changes, its move offers a window into how corporate credit card companies could be stress-tested in the current environment. Brex, Ramp’s biggest competitor, said that there have been no changes to crypto users’ spending limits.”

Around one out of five venture capital funds invested in 2021 went to fintech. This boom is now over, as global fintech funding activity has slowed. returned to pre-2021 levels. Fintech is worse didn’t escape the recent waves of tech layoffsHigh-profile companies like Chime, Brex and Stripe have been the focus of media attention for this sad reason over the last few days. Yet, fintech startups are still being founded and funded in this year. Of the 223 companies in Y Combinator’s summer 2022 batch, 79 fell more or lessinto the fintech sector. Why do investors and founders still invest in fintech? Anna Heim is the author of this article. reached outVC firm focusing on fintech Fiat Ventures.

ICYMI

As reported by Manish Singh: “Shares of PaytmNovember slid to an all-time low of 477 Indian rupees ($5.8), a week after the lockup period for early backers of the Indian financial services firm ended last week and mounting concerns of growing competition.”

Sarah Perez reported: “In November, PayPal-owned Venmo rolled out two changes to its peer-to-peer payments appVenmo allows you to donate to charities and also offers a redesigned money-sending process. The latter aims to make it easier to see how much you’re sending and who you’re sending to, while also improving the ability to either pay or request multiple payments at once.”

And here’s some news that inadvertently got left out of the November 20 edition of our newsletter…my apologies (I blame COVID brain!)! Kyle Wiggers again for writing the write-ups.

Block’s Square wants to get into the credit card game — but it’s going the partnership route to get there. The company announced that it’s teaming up with American ExpressSquare sellers on Amex will be targeted by a new credit-card. Details were tough to come by at publish time — Square says it’ll reveal more about the card early next year — but the press release suggests that the card, soon available to all “eligible” Square sellers in the U.S., will integrate with Square’s existing services to let cardholders organize their finances and manage cash flow from a single pane of glass.

Fintech startups — startups dabbling in banking, investing, budgeting and payments — remainedThis year, fintechs are hot. 18% of global venture funds went to them in Q2 2022. That’s not surprising in light of recent findingsAmplitude, a digital analytics firm, revealed that fintech apps continued to gain new users over last year. This peak was in June and Jul at 22% higher growth than August 2021. These stats match the results of a 2021 Plaid. surveyNearly nine out of ten Americans use fintech apps to manage their finances, according to a study. Clearly, the economic downturn aside, fintech is here to stay — and going strong.

With the “buy now, pay later” (BNPL) market on less firm groundIt is now more difficult than ever for large vendors to find alternative sources of revenue. Enter Klarna’s price comparisonThe BNPL startup has created a tool that can be used to compete with shopping services like Shopping.com or Google Shopping. Built on top of tech acquired through Klarna’s $1 billion acquisition of PriceRunner earlier this year, the new tool allows users to filter product searches by criteria such as size, color, ratings, availability and shipping options and view historical pricing data, which shows how the cost of the product has fluctuated over time. Klarna’s revenue comes from driving traffic and sales to its retail customers.

Speaking of KlarnaCEO Sebastian Siemiatkowski claims that crypto exchanges have collapsed FTX may encourage financial sector regulation that’ll make it harder for fintech firms to compete against traditional lenders. Talking to Bloomberg, he said: “I’m a little bit concerned that these debacles that we’ve seen will again inhibit that and continuously prolong the overly large profitability that we’ve seen in the banking industry.” There’s not a Ton of evidence to support this, but it’s undeniably true that regulators are preparing to take a long, hard look at crypto specifically after years of legislative inaction. The Washington Post reportsThe Treasury Department has called large crypto exchanges to assess the risk of a broader contagion. Several congressional committees have reviewed the requests, including a House inquiry that could see Sam Bankman-Fried, founder of FTX, testify under oath.

Fundings and M&A

TechCrunch – Seen

Consumer finance app Djamo eyes Francophone Africa expansion, backed by new $14M round

Taktile raises $20M to help fintech companies test and deploy decision-making models

Bank engagement startup Flourish Fi leans into concept of ‘banks aren’t going anywhere’

Southeast Asia insurtech Igloo increases its Series B to $46M

AirTree and Greycroft return to lead Australian regtech FrankieOne’s Series A+

Seen elsewhere

Neobank for Native Americans raises pre-seed funding

Peter Thiel’s VC fund backs TreeCard, a fintech that plants trees when you spend

Cross-border payments startup Buckzy raises $14.5 million in Series A financing

Intuit to acquire financial health startup SeedFi

Brazilian unicorn Loft denies receiving down round

Tweet of Week

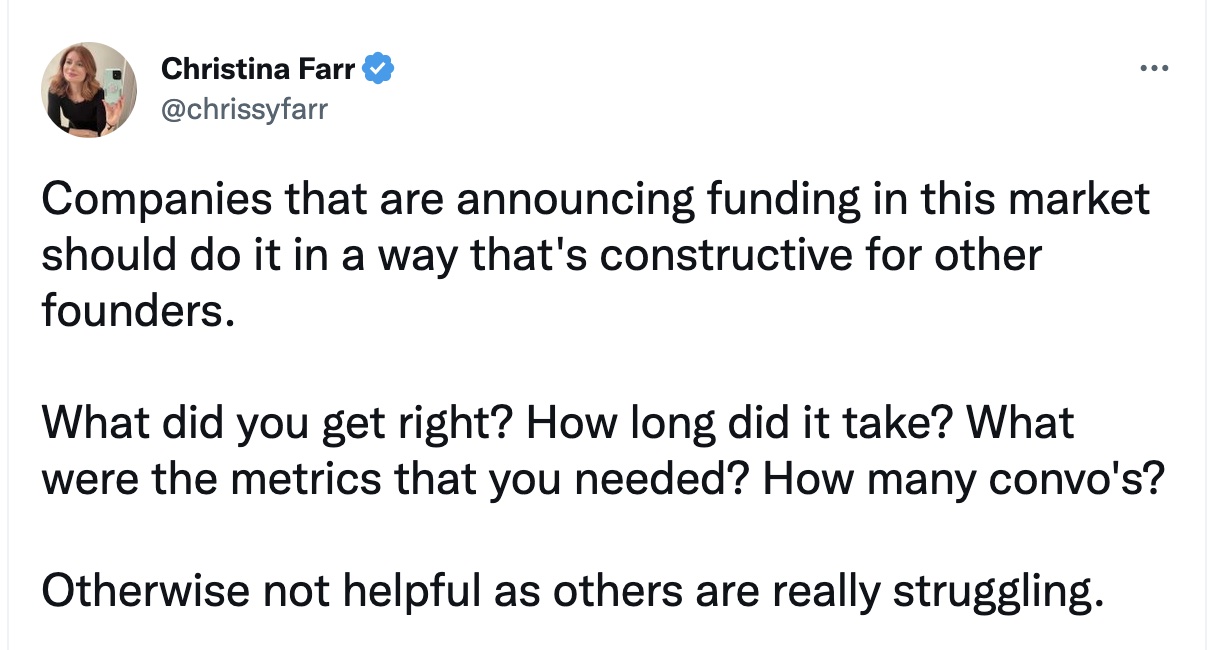

Chrissy Farr, a former journalist and VC, had a notable accomplishment. tweet this week, in which she said: “Companies that are announcing funding in this market should do it in a way that’s constructive for other founders. What did you do right? How long did it take you? What were the metrics you needed? How many convo’s? Otherwise not helpful as others are really struggling.”

This is because my coverage of funding rounds has fundamentally changed since 2021. Let’s be honest — the people usually Most interested in reading about a company’s raise are those that either work at, or have invested in, the company itself. It may surprise you to learn that funding-focused articles aren’t the most popular on the TC site. I realized that it was not in the best interest of our readers to continue covering 10 rounds of funding each week. So these days, I try to focus on companies that (a) are doing something that appears to be really unique or novel and different from existing tech; (b) are willing to share revenue figures or specifics around their financials; (c) have a compelling origin story — say, founders with nontraditional backgrounds or hailed from other high-profile companies or startups; (d) can share specifics and context around their raise and how it came together; and (e) run counter to existing narratives or trends….among a few other things.

The bottom line is that we are constantly bombarded with pitches. You could not even imagine it. We have to be extremely selective about the stories we choose to cover. We must be very selective about what we cover. So, when I say thanks, but no thanks I’m not able to cover your funding round outside of including a mention in my newsletter, please don’t follow up another 10 times. It’s not personal.

Image Credits Twitter

Podcasting

Did you know that I co-host the Equity podcast each week with my dear friends, Alex Wilhelm, and Natasha Mascarenhas. Listen to the most recent episode here. Oh, and I’m SO proud to report that Equity was ranked among the top 5% shared podcasts globally on Spotify!

Also, back in September (I don’t think I ever shared this), I was honored to be a guest on Miguel Armaza’s Fintech Leaders podcast. Among the topics we discussed: why I love covering the startup world and some tips on how to pitch your story to tech reporters, the future of tech media, my idea of what good journalism really means…and a lot more! Listen in here.

And that’s it. Thanks once again for reading/sharing/subscribing. We look forward to seeing you next week! Take care. xoxoxo — Mary Ann

Have a news tip? Inside information? We’d love to hear from you. You can reach me at maryann@techcrunch.com. You can also drop us a line at tips@techcrunch.com. If you prefer anonymity,, click here to contact usSecureDrop (instructions here) and various encrypted messaging apps.

Source link

[Denial of responsibility! reporterbyte.com is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – reporterbyte.com The content will be deleted within 24 hours.]